oklahoma franchise tax online filing

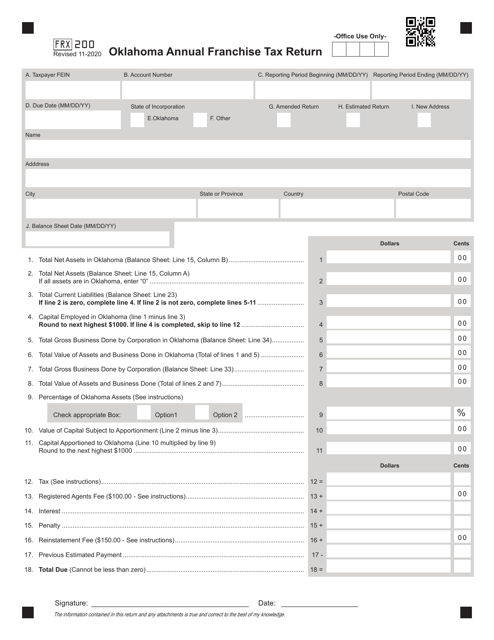

Franchise Tax Computation The basis for computing Oklahoma Franchise Tax is the balance sheet as shown by your books of. These elections must be made by July 1.

Individual Income Tax Electronic Filing

Start your business today.

. You can create an account by clicking. To register as a new OkTAP user click the Register Now button on the top right of the OkTAP homepage and complete the required fields. Commercial Activity Tax The Oklahoma corporate income tax rate is 6.

Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma. Your session has expired. After you have filed the request to change your filing period you will not need to file this form again.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. This form is used to notify the Oklahoma Tax Commission that the below named corporation is electing to. When is franchise tax due.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022. Select Popular Legal Forms Packages of Any Category. You will need to specify one tax account type for.

The report and tax will be delinquent if not paid on or before August 31 and. The 2021 Oklahoma State Income Tax Return forms for Tax Year 2021 Jan. Go to the Oklahoma Taxpayer Access Point OkTAP login page.

The following is the Tax Commissions mission statement. Determine the amount of franchise tax due. With the reorganization of the Oklahoma Tax Commission in 1995 came the refocus of the Tax Commissions goals and objectives.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Forming a corporation in Oklahoma is simple with online filing services from Oklahoma Registered Agent. All Major Categories Covered.

Personal Income Tax The Oklahoma Individual income tax rates range from 05 to 525. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then. 9905 S Pennsylvania Ave STE A Oklahoma City.

Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. Complete OTC Form 200-F. With 100 Accuracy Guaranteed.

Online Filing - Individuals Use Tax -. You can change your filing date by filing Form 200-F Request to Change Franchise Tax Filing Period by mail or online using OkTAP Oklahomas online filing system by July 1st. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Allocated or employed in Oklahoma. File the annual franchise tax using the same period and due date of their. Enter your username and password.

Online Filing - Individuals Use Tax - Individual E-File Income CARS Sales Use Rate Locator Payment Options Tax Professionals. Oklahoma franchise tax is due and payable each year on July 1. Form 200-F must be filed no later than July 1.

You will be automatically redirected to the home page or you may click below to return immediately. Online Filing Oklahoma Taxpayer Access Point OkTAP makes it easy to file and pay. You may file this form online or download it at taxokgov.

To file your Annual Franchise Tax Online. For a corporation that has elected to change its filing period to match its fiscal year the franchise. If filing a Consolidated Franchise Tax Return for Oklahoma the Oklahoma franchise tax for each corporation is computed separately and then combined for one total.

Adjustable Bowtie Geeky Hair Bow World Of Warcraft Bowtie Nerd Geek Wedding Bowtie Geek Gift Mens Bow Tie With Images Geek Wedding Bow Tie Wedding World Of Warcraft

File With A Virtual Tax Preparer Jackson Hewitt

Get 50 Cash In A Flash 875 E Semoran Blvd Apopka Fl 32703 Liberty Tax Tax Services Tax

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Ways To File Taxes For Free With H R Block H R Block Newsroom

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Oklahoma Taxpayer Access Point

Form 200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller

American Opportunity Tax Credit H R Block

Oklahoma Tax Commission Facebook

Luzerne County Pennsylvania 1911 Map Wilkes Barre Plymouth Hazleton Nanticoke Pittston Freeland Fortyfort Wyo Luzerne County Wilkes Barre County Map

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Get 50 Cash In A Flash 875 E Semoran Blvd Apopka Fl 32703 Liberty Tax Tax Services Tax

What Is Franchise Tax Overview Who Pays It More

Tax Day 2022 How To File Your Taxes If You Miss Post Office Hours Marca

Otc Form Frx200 Download Fillable Pdf Or Fill Online Oklahoma Annual Franchise Tax Return Oklahoma Templateroller